Coulter & Justus PC Promotions Announced

Amanda Mynatt, CPA, was promoted to Tax Manager. Amanda joined C&J in 2020, and holds a Bachelor's in Accounting from the University of Tennessee, Chattanooga and a Master’s of Business Administration from Lincoln Memorial University. Eric Lawson, CPA, was promoted to...

Josh Vehec Promoted to Coulter & Justus, PC Principal

Congratulations to Josh Vehec on his promotion to Principal. The Principal position at Coulter & Justus, P.C. represents the highest level of accomplishment and technical service responsibility. This distinction also recognizes Josh for his experience, expertise and...

C&J Wealth Advisors Opportunity

C&J Wealth Advisors has an immediate opening for an Associate Financial Advisor. This is an excellent long-term opportunity for personal and professional growth with a well-established and successful wealth advisory firm. The ideal candidate will have 2-6 years of...

COULTER & JUSTUS, P.C. NAMED 2021 TOP WORKPLACE

Coulter & Justus, P.C. has been awarded a Top Workplaces 2021 honor by Knoxville News Sentinel. The list is based solely on employee feedback gathered through a third-party survey administered by employee engagement technology partner Energage, LLC. The anonymous...

IRS Extends Deadline for 2020 Form 1040

The filing date for individual federal income tax returns has been postponed until May 17. The IRS has announced that individual taxpayers can also postpone federal income tax payments for the 2020 tax year due on April 15, 2021, to May 17, 2021, without penalties and...

Child Tax Credit and Child & Dependent Care Credit

The American Rescue Plan has expanded the Child Tax Credit and the Child and Dependent Care Credit creating major tax benefits for taxpayers with dependent children. The Child Tax Credit has been expanded from $2,000 per child under the age of 17 to $3,000 per child...

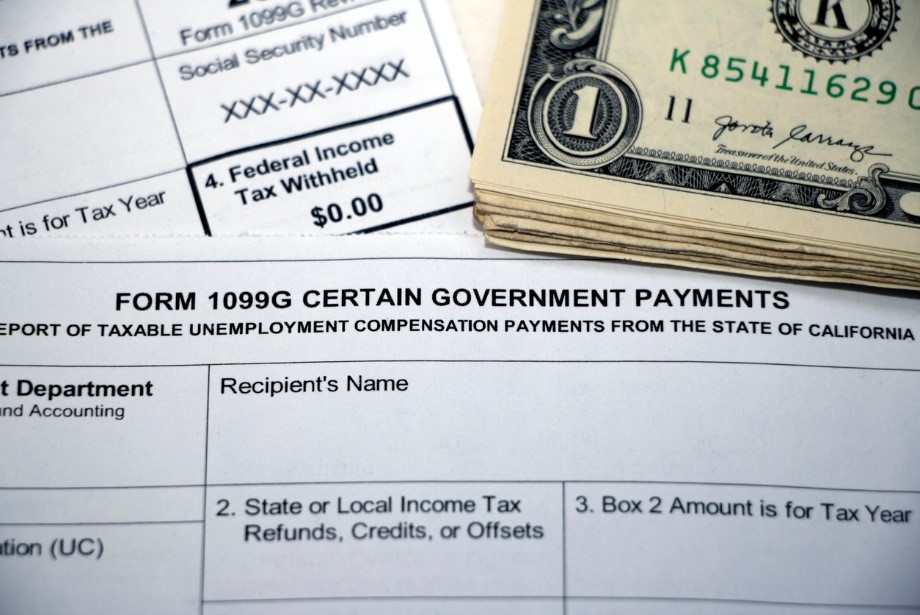

Up to $10,200 of Unemployment Compensation Non-Taxable for Certain Taxpayers

Many taxpayers received unemployment compensation during 2020 due to layoffs and furloughs caused by the Coronavirus Pandemic. If you are one of those taxpayers and your modified adjusted gross income (AGI) is less than $150,000, the American Rescue Plan enacted on...

Breaking News: American Rescue Plan Act

The new $1.9 trillion stimulus bill known as the American Rescue Plan Act will soon land on President Biden's desk for signature. He is expected to sign into law this Friday. The bill contains a wide range of provisions for individuals and businesses, some of which...

Christy Burgess Promoted to Coulter & Justus, PC Principal

Congratulations to Christy Burgess on her promotion to Principal. The Principal position at Coulter & Justus, P.C. represents the highest level of accomplishment and technical service responsibility. This distinction also recognizes Christy for her experience,...

President Signs Year-End Agreement on Pandemic Relief, Stimulus, and Extenders

The Consolidated Appropriation Act, 2021 (Act) generally provides the annual funding for the federal government and contains several important rules giving further COVID-19 relief. These include, among other things, revisions to the Paycheck Protection Program (PPP),...